Medicare

Are you turning 65 or did you pay too much for your Medicare coverage last year?

2026 Open Enrollment is now OPEN October 15th - December 7th, 2025

Medicare is a public health insurance program for people 65 years of age and older.

You’re first eligible to enroll in Medicare 3 months before you turn 65, though you may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig’s disease).

Click here to be led to the official Medicare website, where you login or create an account, find and compare plans, get your questions answered, and file complaints with CMS.

HEADS UP

HEADS UP

We’re sad to say that we were recently informed that HealthPartners’ Medicare Advantage plans will be switching their pharmacy benefit manager (PBM) from MedImpact to Express Scripts in 2026. This move will be devastating to independent pharmacies like us, as Express Scripts—one of the “Big 3” PBMs in the U.S. controlling a significant portion of the prescription market—is well known for under-reimbursing the pharmacies they work with for filling prescriptions and giving vaccinations. At this time, we do not have a Medicare contract agreed to with Express Scripts, as doing so at their current proposed rates would lead to financial loss on nearly 100% of prescriptions. Similar to Medica’s Medicare Advantage plans leaving our network last year, this means that we expect NOT to be able to bill HealthPartners Medicare Advantage plans next year, unless something changes with our contract “negotiations” (because PBMs don’t actually negotiate with independent pharmacies). If you’re a HealthPartners Medicare Advantage patient and would like to continue to have your prescriptions and vaccinations billed through insurance at our pharmacy next year, you may need to consider an alternative to your current HealthPartners plan.

UCare is dropping out of the Medicare Advantage business. If you currently have a UCare Advantage plan—and many of you do—you will need to address this situation during Open Enrollment. Similarly, it is our understanding that other Medicare Advantage plans will be dropping out in specific counties of the state for 2026. Those plans include BCBS, HealthPartners (see above), Aetna, and UnitedHealthcare. If you plan to renew your current coverage for next year, be certain to contact your insurance to make sure your plan is not being dropped. You may think that the plan should notify you if it is going away; they may, but they are not required to. They are only required to inform you of plan changes, such as changes to your deductible, drug formulary, or other coverage parameters.

Anyone whose plan is going away next year (as is the case with UCare, as mentioned above) has a unique, no-questions-asked opportunity to transition to Traditional Medicare A & B WITH a supplement (“medigap” plan) and a drug plan. If you are affected by this change, we STRONGLY recommend you explore this option.

If your plan is dropped and you do nothing, you will revert, by default, to Traditional Medicare A & B WITHOUT a supplement… Leaving you to find yourself in January or February 2026 with only Medicare A & B coverage (80% of any medical expense). Twenty percent of a hospital stay or other large medical expense is a large sum of money that you would be responsible to pay if you have traditional Medicare without a supplement due to the discontinuation of your current plan. Please, DO NOT ignore this issue and assume you will be ok—do your research and make a plan that fits your health needs and budget.

Medicare Advantage networks are shrinking fast, limiting patient access to the providers they want to use for their care. This is evident in the fact that we are currently without a service contract for 2026 Medicare Advantage plans offered by Medica, HealthPartners, Cigna, and Humana. Additionally, we do not have a contract for the Part D drug plans offered by Cigna or Wellcare. That, at least for now, theoretically leaves you with BCBS, Aetna, and UnitedHealthcare for Medicare Advantage and Part D plans as the only current options to choose if you want to continue having us fill and bill your prescriptions and vaccines using insurance in 2026.

Our Cost Plus self-pay program is still available to ALL patients, regardless of whether your insurance plan is accepted at SPCD. If you take inexpensive, generic medications, this is probably a great option for you for several reasons, and it helps financially support our business because it ensures we’re being compensated fairly. If you are not familiar with this option, we would be happy to discuss it with you during your next visit to the pharmacy!

NEW in 2025 from the Centers for Medicare & Medicaid Services (CMS)

Medicare Prescription Payment Plan

As a part of recently-enacted Inflation Reduction Act (IRA), CMS is now required to offer individuals on Medicare the option to participate in the new Medicare Prescription Payment Plan (MP3). MP3 is a payment option in the prescription drug law provision of the IRA that helps patients manage their out-of-pocket costs for drugs covered by their plan by spreading them across the calendar year (January–December). Participation in the payment plan is voluntary and open to all Medicare enrollees with prescription drug coverage; however, be aware that it does NOT lower your overall drug costs. Click here to learn more about this new payment option.

P.S. We’d like to point out that, while this payment option might greatly benefit patients, it does nothing to address the fact that pharmacies like us are still underpaid to fill the expensive drugs that are taken by patients who will most benefit from participation. To learn more about how Medicare plays a part in pharmacy benefit manager (PBM) abuse, scroll down or visit our Advocacy tab.

Medicare counseling with Conner

After realizing his own growing concerns with how Medicare plans are coordinated and marketed to patients in the US, Conner came into our pharmacy ready to learn about how pharmacy care factors into patients’ Medicare coverage (and how Medicare plans are currently a big reason why pharmacies like us are going out of business). As a licensed insurance broker, we’ve come to know and trust him to provide FREE counseling to our patients who are already on Medicare or going to be joining the program soon. He’ll meet with you to help you find the best plan to fit your current health needs. He also helps teach our FREE Medicare 101 class!

Want to schedule a meeting with Conner?

connerkoker@themedicarebroker.com

themedicarebroker.com

(651) 432-5555

Do you like your insurance broker? Or need a recommendation?

Due to significant changes in Medicare this Open Enrollment season, we’ve begun compiling a list of quality insurance brokers using recommendations from our own patients to help folks get connected with someone who can assist them with figuring out their best options for insurance.

NOTE: We are not legally affiliated with nor officially endorse any of the insurance brokers named in the above-linked Google Sheet.

Thank you for your input! We hope that it will help support your fellow Medicare enrollees in the SPCD community.

Open Enrollment

Medicare Open Enrollment takes place every fall season and is an opportunity for you to switch insurance coverage to a plan that best suits your health needs or select a Medicare plan for the first time, if you’re about to turn 65.

Open Enrollment for 2026 Medicare insurance plans is now open through December 7th, 2025. Information about the plans that will be accepted at our pharmacy in 2026 can be found below (see “2026 Medicare Plans Accepted at SPCD”).

Be aware that Medicare part D coverage at our pharmacy (and other independent pharmacies across the US) is expected to be extremely limited given current contract negotiations with the Pharmacy Benefit Managers (PBMs) that operate on behalf of private Part D plan sponsors. In short, the contracts PBMs offer to pharmacies like us these days are almost all financially detrimental for us to accept, offering us below-cost reimbursement on a significant portion of the prescriptions we fill. They claim that this helps them “keep costs low” for patients like you and “reign in drug pricing,” but, in actuality, it has led to higher costs for patients, pharmacies, AND payers (including the federal and state governments, in the case of Medicaid and Medicare plans).

If you haven’t already, we recommend creating a free online account at Medicare.gov, which gives you access to their plan comparison tool as well as resources for learning about Medicare, finding care providers, comparing procedure costs, submitting complaints, and more.

If your selected plan for next year IS accepted at our pharmacy, pass that information along to our staff in person or over the phone as soon as you receive it from your selected insurance plan (we need your plan name, (Member) ID, RxBIN, RxPCN (if you have one), and RxGRP (if you have one).

If your selected plan for next year is NOT accepted at our pharmacy next year, no fear! We can still fill some or all of your prescriptions out of pocket through our Cost Plus self-pay program and counsel you about alternative ways to fill your expensive brand name medications, if you take any. (Brand name medications are unaffordable for most patients to pay for out of pocket.)

If you’d like to keep informed about Medicare-related updates (and other important announcements!) at St. Paul Corner Drug, consider signing up for our news bulletin, the DOSE.

Medicare coverage at SPCD

Want to continue receiving updates about Medicare at SPCD?

Subscribe to our news bulletin, the DOSE!

-

Because your insurance will be billable at our pharmacy, you'll be able to use your insurance coverage or participate in our Cost Plus self-pay program, wherein you pay for your prescriptions out of pocket.

If this is you, keep in mind that there are a number of benefits to participating in Cost Plus, even if it isn’t cheaper than using insurance.

-

If you want to continue filling prescriptions at our pharmacy, you'll need to do so via our Cost Plus self-pay program.

If this is you, keep in mind that this will impact our ability to bill your vaccinations to insurance.

-

Once available, see above on this page for a listing of 2025 Medicare plans that will be accepted at our pharmacy. Please note that we often aren’t privy to this information until the beginning of Open Enrollment on October 15th.

Is your insurance plan for next year going to be accepted at our pharmacy?

Check out your options for filling prescriptions and receiving vaccinations using your answer and the dropdown menu.

Medicare reform is sorely needed

and, hopefully, on the horizon.

For years, private insurers and PBMs have managed to steal billions of dollars through the administration of Medicare Advantage (Part C) plans (you can read more about that further down this page under “How Medicare works”). Instead of making sure our country’s seniors and people with disabilities are cared for, private insurers and PBMs are accepting money from the US government meant to cover the cost of life-saving healthcare, outright denying that care or making it extremely inaccessible, and then keeping the profits for themselves. The stories from patients like this—who have been harmed by Medicare Advantage—are endless (click here for a video from the New York Times specifically about Prior Authorizations (PAs) and care denial, which are issues commonly experienced by patients with a Medicare Advantage plan).

For years, retirees have been pushed to select these “low-cost” plans in place of traditional Medicare (or, even, forced to if it’s the only option their retirement benefits offer). However, they’ll now be the ones to face the consequences of insurance companies ceasing to provide these plans as the system crumbles and, with it, insurers and their PBMs’ potential to profit off their privatization.

The #InsuranceReform movement needs YOU.

Click here to learn how you can help advocate for patients like yourself and pharmacies like us and here to sign up with the Be A Hero Action Fund to help spread the word about modernizing Medicare and protecting patients on Medicare Advantage.

Understanding your coverage

The rest of this page includes information and resources about how Medicare works in general and at our pharmacy in particular, as well helpful guidance from us about how we think patients might go about choosing a Medicare plan.

Ultimately, you can’t be an informed consumer of healthcare without understanding how it works (and how it doesn’t work, given the state of our crumbling health system), as well as your options for filling prescriptions and receiving vaccinations at our pharmacy.

Coverage to Care

Coverage to Care (C2C) is an initiative developed by the Centers for Medicare & Medicaid Services (CMS) to help you understand your health coverage and connect you to the primary care and the preventive services that are right for you. Whether you’re an individual managing coverage for you and your family or a provider or organization helping those in your community manage their care, C2C has resources that can help.

Download the C2C overview fact sheet (PDF) to find out how C2C can benefit you, whether you’re trying to better understand your own health coverage or someone helping others in your community.

Other educational resources

NOTE: We are not legally affiliated with nor officially endorse the content provided by the entities below. We are simply referencing them as another means for you to educate yourself about the Medicare program.

MedicareSchool.com

Our owner, John, likes MedicareSchool.com’s host Marvin Musick’s ability to communicate information in a presentable manner. Their site offers various workshops and access to Medicare Guides who offer free broker services to connect you with the Medicare plan that best fits your needs.

Medicare Interactive from the Medicare Rights Center

Medicare Rights Center is a national nonprofit consumer service organization that “works to ensure access to affordable health care for older adults and people with disabilities through counseling and advocacy, educational programs, and public policy initiatives.” Their Medicare Interactive page offers several in-depth webpages on different aspects of the Medicare program as well as tailored courses and webinars.

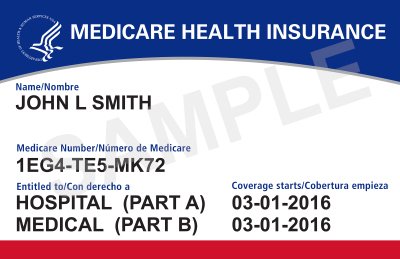

Your Medicare card

Your Medicare card has a Medicare Number that’s unique to you (it’s no longer your Social Security Number, which used to be the case). This helps protect your identity. If you still have a Medicare card that lists your Social Security Number, leave this card in a safe space at home and contact Medicare ASAP to request that they send you a new card!

The card shows:

You have Medicare Part A (listed as HOSPITAL), Part B (listed as MEDICAL), or both

The date your coverage begins

Bring this card with you, along with any additional health insurance cards (e.g., for supplemental or prescription drug coverage), to all health appointments.

How Medicare works

The basics

There are different “parts” that together make up a Medicare patient’s health insurance coverage:

Part A = Hospital coverage (this is also what your doctor bills when they see you; you can think of it as “services”)

Part B = Medical coverage (think of this as “stuff,” such as diabetic testing supplies)

Part D = Prescription (drug) coverage (what we, as a pharmacy, bill when we fill your prescriptions or vaccinate you)

Part C = Medicare Advantage coverage, which is NOT Medicare; rather, it’s private insurance that “bundles” Parts A, B, & D together into a “Part C” plan paid for by Medicare (see below for more information about this distinction!)

A note on Medicare “Dis-Advantage” plans

Please practice caution when considering a Medicare Advantage (also known as Medicare “Part C”) plan. These private insurance plans are advertised as a brilliant “bundled” option for all Medicare-covered services, but in reality often severely limit a patient’s care options and then prohibit them from further supplementing their coverage where needed. For example, these plans are notorious for denying the coverage of claims for Medicare-required services and getting away with it, likely due to a lack of oversight from entities like the US government and patients’ inability—for a variety of reasons—to fight denied claims. Click here to read a short PDF summary of Physicians for a National Health Program’s (PNHP’s) Taking Advantage: How Insurers Harm Seniors on Medicare report (the full report, including an executive summary, can be found here).

In other words, if a Medicare plan seems too good to be true—such as covering “all” of your health services with a $0 premium—it probably is. In a for-profit healthcare system like ours, you’re going to end up paying for your health services one way or another. If you have questions about this, feel free to give us a call and we’d be more than happy to talk with you about it.

See below for a side-by-side comparison of traditional Medicare and Medicare Advantage.

TRADITIONAL MEDICARE

with a supplement plan

A public insurance program available to all Americans 65+ who worked & paid into the system

Part A (hospital) + Part B (medical) + Part D (drug)

YOU & YOUR PROVIDER CHOOSE YOUR CARE

NO REFERRALS NEEDED

BROAD NETWORK OF PROVIDERS

NO FEES

NO PRIOR AUTHORIZATIONS (PAs) ON COVERED SERVICES

NO HIDDEN COSTS

FULL COVERAGE

MEDICARE ADVANTAGE

is NOT Medicare

Private insurance that “bundles” Parts A, B, & D together into a “Part C” plan paid for by Medicare

Commonly advertises $0 premiums

YOUR PLAN CHOOSES YOUR CARE

HIGHLY RESTRICTED REFERRALS

LIMITED ACCESS TO SPECIALISTS

LAB, MRI & OUTPATIENT FEES

PRIOR AUTHORIZATIONS (PAs) FREQUENTLY REQUIRED

UPFRONT COPAYS ON OFFICE & ER VISITS

LIMITED COVERAGE DETERMINED BY PLAN

HIGHER DEDUCTIBLES & OUT-OF-POCKET COSTS

for, often times, inadequate coverage…

Additionally, Medicare drug coverage works through 4 phases across the course of a year (3 phases starting in 2025; see note below). Read on for more information about each of these stages. Additionally, you can login to your account at Medicare.gov to see an estimate of when you’ll reach each stage of Medicare coverage on your current or future insurance plan.

Phase 1 = Deductible (if the plan has one)

Phase 2 = Initial coverage

Phase 3 = “Doughnut hole” (coverage gap), when your copays will be highest

Patients usually only reach this stage is they take at least one expensive (usually brand name) medication

Starting in 2025, this stage will no longer exist. Instead, patients who reach the out-of-pocket threshold of $2,000 will automatically move from initial coverage to the catastrophic stage.

Phase 4 = Catastrophic coverage, when your copays will be lowest

Patients usually only reach this stage if they take several expensive (usually brand name) medications

Did you know that all Medicare plans send their covered members a monthly statement?

These statements detail exactly where you’re at across the stages of Medicare Part D (drug) coverage and are a great way to keep track of your expenses as well as help you decide what plan might be the best fit for you in the coming year.

Costs for Medicare drug coverage

As part of your Medicare Part D (the “D” stands for “drug”) coverage, you’ll make payments throughout the year covering your:

Premium = the monthly fee you pay to participate in that plan

Annual deductible = the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share

The standard deductible increased from $505 in 2023 to $545 in 2024

Some Medicare plans don’t have a deductible, and the deductible can vary between those that do. No Medicare drug plan can have a deductible greater than $545 in 2024 (it was $505 in 2023).

An annual deductible is why many patients have a few high copays at the beginning of the year; since their insurance isn’t yet contributing to any cost sharing on their prescriptions, even though prescriptions are being billed to their plan, the plan isn’t “covering” any of the cost.

Copayments or coinsurance = the amounts you pay for your covered drugs after you’ve met your deductible (see above), if your plan has one

Copay = a set rate you pay for prescriptions, clinic visits, and other types of care

Coinsurance = the percentage of costs you pay after you've met your deductible

These amounts may vary because drug plans and manufacturers can change what they charge at any time throughout the year. The amount you pay will also depend on the tier level assigned to your drug (click here to read more information about how drug tiers work). Your copay and/or coinsurance rates can increase throughout the year if a manufacturer raises the price of a drug you take or if you continue taking the brand name form of a drug when a generic becomes covered by your plan (i.e., is added to their “formulary”). Check out the video above to understand how your drug costs can change over time.

Costs in the coverage gap (“doughnut hole”) = a stage of Medicare drug coverage in which there’s a temporary limit on what your plan

will cover for prescriptionsMost Medicare drug plans have a coverage gap, but not everyone will enter it during the course of a calendar year. The coverage

gap begins after you and your drug plan have spent a certain amount for covered drugs; in general, we find that many of our

Medicare patients taking expensive brand name drugs reach this gap about 3/4 of the way through any given year (the coverage

gap is the third of four stages of Medicare coverage and the final one before entering the “catastrophic” stage, wherein your costs

to fill your prescriptions will be at their lowest).

Costs if you get Extra Help = a Medicare program to help people with limited income and resources pay for Medicare Part D premiums,

deductibles, coinsurance, and other costsCosts if you pay a late enrollment penalty = an amount that can be added to your Medicare drug coverage (Part D) premium if, at any

time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage

or other creditable prescription drug coverageYou’ll generally have to pay the penalty for as long as you have Medicare drug coverage, so its important to do what you can to avoid this!

The out-of-pocket spending threshold increased from $7,400 in 2023 to $8,000 in 2024 (equivalent to $12,477 in total drug spending in 2024 compared to $11,206 in 2023). The out-of-pocket threshold in 2025 is being lowered to $2,000.

Your actual drug costs will vary depending on:

Your prescriptions and whether they’re on your plan’s list of covered drugs (“formulary”, which, notably, is determined by your insurance plan’s PBM)

What tier the drug is in (see above)

Which drug benefit phase you’re in (like whether you’ve met your deductible, or if you’re in the catastrophic coverage phase)

Which pharmacy you use (whether it offers preferred or standard cost sharing, is out of network, or is mail order). Your out-of-pocket drug costs may be less at a “preferred” pharmacy because it has agreed with your plan to charge less, but this isn’t always the case; the use of the terms “in-network” and “preferred,” frustratingly, DOES NOT always equate to cheaper care.

Whether you get Extra Help paying your Medicare drug coverage costs

The above information is adapted from Medicare.gov, the US government’s official website for Medicare. Click here to read more detailed information on costs for Medicare drug coverage on their site and here to check out their Coverage to Care (C2C) initiative, which aims to help you understand your health coverage and connect you to the primary care and the preventive services that are right for you.

Our thoughts on choosing a Medicare plan

Understanding Medicare prescription plans can seem daunting, but it doesn’t have to be.

Below are the things we at St. Paul Corner Drug want you to know as you embark on the process of selecting a Medicare health insurance plan for this or next year.

Do your research

Choosing a health insurance plan should NOT be something you do based on the recommendation of fellow seniors. Rather, it’s important to, as our teacher friends say, “do your homework” and research available options that will best suit YOUR healthcare needs. Similarly, it’s important to research available plans EVERY YEAR, rather than continuing to select the same plan you’ve been on… just because. Jay Norberg, a fellow independent pharmacy owner in Minnesota, crafted a short but sweet summary [audio recording available] on why researching Medicare plans every year is not just recommended, but necessary, to ensure you’re not overpaying for your prescriptions and pharmacy care. Like Jay, we’re not legally an insurance agent who sells insurance nor can we recommend a particular insurance plan; however, we CAN help guide you in your choice of a Medicare drug plan for this coming year.

If you’d like personalized assistance from a licensed insurance broker, considering reaching out to our friend and fellow pharmacy advocate, Conner Koker, at connerkoker@themedicarebroker.com or (651) 432-5555. He’ll meet with you FREE of charge and help you find the best plan to fit your current health needs. He also helps teach our FREE Medicare 101 class!

Comparing plans

The best way to find a plan that is the most cost-effective given the medications you take and will allow you to receive care from your current providers (including us!) is to visit Medicare.gov and utilize their plan comparison tool. Additionally, you can click the button below to view a spreadsheet listing the Medicare plans that are being accepted at our pharmacy this year (data for 2025 is not expected to become available until the beginning of Open Enrollment on October 15th, but will be available here as soon as it is). Please be aware that the variety of Medicare plans we are able to accept at our pharmacy has continued to dwindle as PBM abuse worsens (the reason we don’t accept plans is because it would be financially detrimental for us), and is expected to be even more limited in 2025. Popular Minnesota plans that we aren’t accepting in 2024 include Blue Cross Blue Shield, Humana, and Medica.

Remember: just because your plan was a good fit for you this year doesn’t mean that will be true next year. Plans change (often with little transparency), and so do your health needs!

Plans accepted at our pharmacy

Plans that are accepted at our pharmacy are also called “in-network” (as mentioned above, watch out for words like “preferred” / “not preferred”). Click the button below for a quick reference on what Medicare plans are being accepted at our pharmacy this year (complete data for 2025 is not expected to become available until mid-November, but will be available on this page as soon as it is).

If you’re new to Medicare and have recently researched and selected a plan for this year that is NOT listed on the spreadsheet linked to the button below, please be aware that you’ll need to plan to fill your generic prescription(s) through our Cost Plus self-pay program in order to continue filling prescriptions at our pharmacy through the end of 2024 (we can counsel you about alternative ways to fill your expensive brand name medications, if you take any, as these are unaffordable for most patients to pay for out of pocket).

Consider how your choice affects vaccination services

If you ultimately select a plan that isn’t accepted at our pharmacy, the kind of Medicare plan it is will determine whether we can bill your vaccines to insurance:

If you have traditional Medicare with a Part D plan for your drug coverage, we will only be able to bill COVID, flu, and pneumonia vaccination to your insurance (because these vaccinations are currently covered by Medicare Part B).

If you have a Medicare Advantage (Part C) plan, we won’t be able to bill ANY vaccinations to your insurance.

The cost of any vaccine paid for out of pocket includes the raw cost of that vaccine plus an administration fee (similar to how Cost Plus charges the patient the raw cost of the drug plus a dispensing fee). This can range from tens to hundreds of dollars, depending on the vaccine.

Our take on available plans

Regardless of what medications you do take (cheap generics vs. expensive brand name drugs), you may want to consider the value of selecting the most affordable plan available to you and, additionally, consider participating in our Cost Plus self-pay program. While this may give you cause for concern (doesn’t that mean my pharmacy care won’t be covered?), we suspect this approach might make the most sense for a majority of our Medicare patients when considering the intricacies of insurance in our nation.

Unfortunately, the American insurance industry is for-profit and benefits financially from a lack of transparency and preventing patients from being informed consumers; this is why health insurance plans can change drastically from year to year (and even within the coverage year). Additionally, we can assure you that, if you’re taking any number of brand name medications (common ones include Advair, Eliquis, Ozempic, and brand-name insulins like Humalog and Novolog) either because these medications don’t have a generic alternative (common), your insurance requires that you take the brand-name version (common), or because your body responds best to this version of these medications (uncommon), these are going to be expensive no matter what plan you select.

By choosing a plan with a more affordable monthly premium and deductible, you’re keeping more of your money in your own pocket to fund your care how you choose instead of surrendering it upfront to an insurance company that (if we’re being honest) probably doesn’t have your best interests at heart.

Consider Cost Plus

Keep in mind that we now offer a self-pay program called Cost Plus, wherein we bypass patients’ insurance and instead charge them the raw cost of their medication plus a dispensing fee that accurately reflects our operating costs (hence the name “Cost Plus”). Even if the Medicare Part D plan you select is accepted at St. Paul Corner Drug, this could be a great way for you to:

Save money

Avoid the hoop-jumping often required when using insurance and/or

Support us financially as we, like all other independent pharmacies in the US who accept insurance, struggle to stay open while waiting for legislative action to address Pharmacy Benefit Manager (PBM) abuse

And, if the Medicare Part D coverage you select is NOT accepted at our pharmacy, this is a way for us to continue filling your generic prescriptions.

How can Cost Plus save me money?

For many patients, the price they pay to fill their prescriptions through Cost Plus (in general, the raw cost of the drug plus a dispensing fee) will actually be less than what they would pay if using insurance. This is because, as time has gone on, the insurance industry has become more about making money than taking care of patients. The complicated nature of the industry and intricacies of each health plan further muddy the waters, making it easy for patients to think they’re paying less when using insurance even though this turns out not to be the case when we crunch the numbers. See below for a few real life examples from actual SPCD patients.

How does Cost Plus help me avoid hoop-jumping?

Using insurance means being subject to the various “hoops” the industry has developed to avoid having to cover the cost of patients’ medications. These include things like Prior Authorizations (otherwise known as “PAs,” which must be applied for and approved when a drug isn’t covered on a patient’s plan), vacation overrides, and lost medication overrides. Additionally, the logistics of interfacing with the insurance industry further complicates the filling of prescriptions: long wait times for phone calls with insurance companies, unhelpful phone operators, the provision of misinformation, and billing challenges, to name a few. When filling your prescriptions via a self-pay model instead, these hoops become irrelevant—you can fill your medication whenever you want, for the quantity you want, within the constraints of the prescription itself and as long as its medically appropriate.

How does Cost Plus support us financially?

As you’ve probably heard, we (and probably every other independent pharmacy in America that accepts insurance) currently lose money dispensing prescriptions. In short, this is because of the pervasive, abusive conduct of PBMs (the middleman between pharmacy providers like us and payers like insurance companies and the state/federal government).

Our industry, unfortunately, is unique in the fact that we are told both what we have to pay for a drug that we want to carry in our store and what we will be paid when we fill it—often just cents on the dollar, or even sometimes a negative amount that puts us in the red. At this time, approximately 60% of prescriptions filled at retail pharmacies—both chain and independent—are paid out by insurance companies below cost, which makes it nearly impossible for us to remain viable businesses in our communities. Additionally, prescriptions billed to Medicare health plans through December 31st, 2024 carried an additional complication in the form of a DIR fee (colloquially known as a “clawback”). These clawbacks are fees that we had to pay back to PBMs every trimester and were part of the Medicare Prescription Drug Improvement and Modernization Act of 2003 (MMA) legislation that created the Medicare Part D program and Medicare Advantage plans, which went into effect in 2006. They were non-itemized (i.e., calculated with zero transparency), collected retroactively, and grew exponentially with time (in 2022, our pharmacy paid out $368,000 in DIR fees—an amount that would cover the annual salary and benefits of two full-time Pharmacists). While these fees are now collected on a daily basis since they became “illegal” on January 1st, 2024, for a long time they were a legal way for PBMs to steal monies already paid out to pharmacies like us for pretty much zero reason other than… They could. (And, if we’re being honest, PBMs are now simply collecting these kinds of fees directly within the prescription claim instead of retroactively, or via other means). And they will continue to do so without significant legislative reform (and probably a long road of growing pains, too). By becoming a Cost Plus patient, you’ll be helping us subvert the financial burden we currently carry from doing our essential work filling prescriptions and, hopefully, help us remain a thriving community-based business and healthcare provider for many years to come.

If you decide that you’d like to participate in Cost Plus, please give us a call and ask to speak with one of our Pharmacists or Pharmacy Technicians about the program (alternatively, you can send us a message here). If they don’t have time to chat with you in the moment, they’ll give you a call back when they’re able. When you eventually connect with the Pharmacist or Technician, they’ll answer any remaining questions you have and educate you about next steps for participating in the program, including completing our Patient Authorization for Self-Pay (HITECH) form, which is required for all Cost Plus participants.